Financial Report

Management Report

Legal and regulatory environment

The electricity industry’s value chain can basically be divided into the following areas: electricity generation, electricity transmission, electricity distribution and electricity consumption. As the owner and operator of Switzerland’s extra-high-voltage grid, Swissgrid is responsible for electricity transmission.

The high investments for the construction of the transmission system, rising economies of scale (in view of falling marginal costs) and high irreversible costs result in a natural monopoly in the area of electricity transmission. This has been structured as a legal monopoly by the legislator based on the Electricity Supply Act (StromVG) and the Electricity Supply Ordinance (StromVV). To strengthen the supply of electricity in Switzerland, the Winter Reserve Ordinance (WResV) was also enacted in February 2023. The Federal Electricity Commission ElCom oversees compliance with StromVG, StromVV and WResV.

It is the independent state regulatory authority in the electricity industry and is allowed to issue rulings where necessary, against which there is a right of appeal to the Federal Administrative Court with the possibility of appeal to the Federal Supreme Court.

Given the public interest in the secure national supply of electricity, the resulting legislation and relevant supervision by the regulator, Swissgrid’s business activities are overwhelmingly subject to strict regulation.

Business activity

As the National Grid Company, Swissgrid is responsible for the non-discriminatory, reliable and efficient operation of the transmission grid as well as its sustainable and efficient maintenance. The renovation and demand-driven expansion of Switzerland’s extra-high-voltage grid are also considered amongst the company’s most important tasks.

Swissgrid also provides additional services, such as balance group and congestion management or ancillary services (AS) as part of European and Swiss interconnected operations. In addition to representing national interests, Swissgrid makes an important contribution to ensuring the secure supply of electricity for Switzerland.

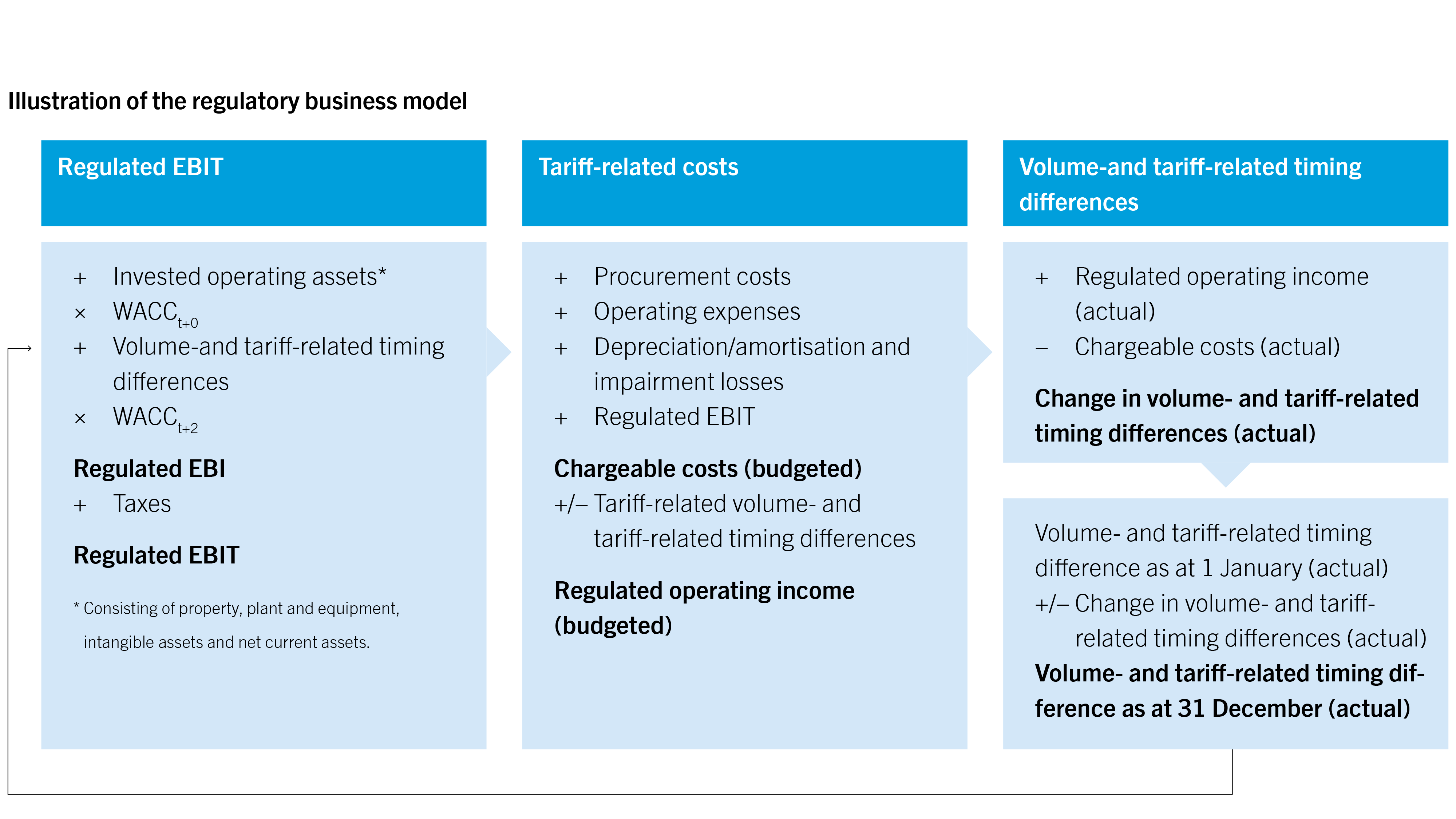

Cost-plus regulation

Swissgrid’s legal mandate and business activities expose the company to costs that can be passed on to the lower grid levels and end consumers in the form of tariff revenues if the regulator deems the costs to be chargeable. ElCom has the right to verify ex post the chargeability of Swissgrid’s costs for tariff-setting purposes.

Chargeable costs include the operating and capital costs of maintaining a secure and efficient grid. The chargeable costs according to StromVG and StromVV also include an adequate operating profit. As a result, this is referred to as «cost-plus» regulation: «cost» stands for the cost recovery principle and «plus» stands for the operating profit. The cost recovery principle applies to the chargeable costs according to WResV.

Chargeable operating and capital costs

Chargeable operating costs include the costs for services directly related to the operation of the grid. Examples include costs for maintaining the grid, costs for providing ancillary services, personnel expenses, costs for materials and third-party supplies, and direct income taxes.

Chargeable capital costs include depreciation/amortisation and imputed interest. The amount of imputed interest is directly dependent on the assets required to operate the grid (invested operating assets (IOA)) and the applicable regulatory interest rate (WACCt+0). WACCt+0 means that the WACC specified for this year also applies to the current financial year.

In particular, IOA consist of transmission grid assets (including construction in progress), intangible assets and net current assets determined on a monthly basis.

Volume- and tariff-related timing differences

Swissgrid calculates the required tariff revenues ex ante based on budgeted costs (operating and capital costs). Volume and price differences between the «actual» situation for a year and the «budgeted» situation for the same year regularly lead to differences between the actual costs and actual income for a year. These differences are referred to as volume- and tariff-related timing differences and are rectified over the coming years. If effective costs exceed the tariff revenues for the same year, this results in a deficit. This deficit can be eliminated over subsequent years by increasing the tariff.

By contrast, if tariff revenues exceed effective costs for the same year, this results in a surplus, which must be used to reduce tariffs over subsequent years.

Volume- and tariff-related timing differences according to StromVG and StromVV are also subject to interest at the WACC rate and have an impact on capital costs. In contrast to IOA, volume- and tariff-related timing differences are subject to interest at WACCt+2. Deficits increase capital costs, while surpluses reduce them. Volume- and tariff-related timing differences resulting from the implementation of the specified measures from WResV are not subject to interest.

Profit regulation

The legal framework in place for Swissgrid means that the EBI (earnings before interest) of the regulated business area is essentially a multiplication of the invested operating assets with the capital cost rate (WACCt+0) and the interest applied to the volume- and tariff-related timing differences (WACCt+2). Additional profits may arise from Swissgrid’s unregulated business area.

The EBI is then used to compensate Swissgrid’s stakeholders via interest on liabilities and return on equity (dividends and/or profit retention). The cost-plus regulation therefore leads to a return in the amount of the capital cost rates to be applied.

Imputed capital cost rate (WACC)

The WACC is an imputed interest rate defined annually based on the electricity supply legislation. It applies equally to all grid operators.

The WACC is calculated methodically taking account of the current Best Practice guidelines provided by the Federal Department of the Environment, Transport, Energy and Communications (DETEC). The methodology was developed specifically for the regulation of electricity grid operators and intends to ensure security of investment for these operators. With regard to the financing structure, the WACC calculation assumes an equity share of 40% and a borrowed capital share of 60%. Specific thresholds apply for the individual capital cost parameters.

As the WACC represents an imputed interest rate for the electricity industry, Swissgrid’s actual capital costs are not included in the tariff calculation. On the other hand, this means that Swissgrid is responsible for determining how the imputed interest received via the tariffs is distributed to shareholders and lenders.

Business performance

(values pursuant to Swiss GAAP FER)

Procurement costs

At CHF 899.9 million, procurement costs are CHF 33.7 million higher than the previous year’s value of CHF 866.2 million. This increase is primarily due to higher costs for reactive energy (CHF 6.6 million) and active power loss (CHF 9.9 million). The rise in the reactive energy segment is due to the higher pro rata voltage maintenance costs payable by this segment. The rise in the active power loss segment is due to higher prices for the procurement of the energy required to compensate for active power losses. In contrast, costs in the grid usage and general ancillary services segments remained at the previous year’s level.

Operating expenses and depreciation/amortisation

Operating expenses rose by CHF 43.2 million year on year, from CHF 250.6 million to CHF 293.8 million. The increase is mainly due to the launch of several measures associated with the initial implementation of Strategy 2027, which resulted in higher costs in materials and third-party supplies and in personnel expenses year on year. The average number of full-time equivalents in 2023 amounts to 704.3 FTE (previous year: 630.9 FTE).

The scheduled depreciation/amortisation on property, plant and equipment and intangible assets amounted to CHF 146.1 million in the reporting year, down CHF 9.6 million on the previous year. The decrease is attributable to assets that had already been fully depreciated in the previous year and to auction income received for the maintenance and expansion of the transmission grid in 2022 and 2023.

Revenue and volume- and tariff-related timing differences

For the 2023 financial year, net turnover across all segments amounts to CHF 1,219.2 million. This represents an increase of CHF 232.1 million in relation to the previous year’s figure of CHF 987.1 million. The rise is mainly attributable to the general ancillary services (CHF 191.2 million) and active power loss (CHF 71.7 million) segments. The increase in the general ancillary services segment is the result of higher tariff revenues, higher income from balance group/balancing energy and the higher auction income to cover the chargeable costs of the transmission system allocated to this segment. Net turnover in the active power loss segment increased due to higher tariff revenues and higher pro rata income from the compensation for international transit flows (ITC) and auctions. By contrast, income in the grid usage segment fell by CHF 46.1 million in relation to the previous year due to the lower income from ITC and auctions allocated to this segment. Revenue in the reactive energy segment remained at the previous year’s level.

In the 2023 financial year, the operating business activities reported net deficits (cumulative deficits less cumulative surpluses) of CHF 216.4 million (previous year: CHF 370.7 million). In particular, the general ancillary services and active power loss segments posted deficits of CHF 170.9 million and CHF 77.2 million respectively due to the higher procurement costs. In addition, the costs resulting from intermediary transactions in the power reserve segment increased by CHF 403.2 million compared to the previous year, which explains the net deficit of CHF 1,367.3 million as at 31 December 2023 (previous year: CHF 747.7 million).

EBIT, financial income and net income

Earnings before interest and taxes (EBIT) from activities relating to the Federal Electricity Supply Act (StromVG) are equivalent to the interest applied to the assets required for grid operations using the weighted average cost of capital rate for the current year under review (= WACCt+0) and the interest applied to the volume- and tariff-related timing differences with WACCt+2 plus income taxes. The weighted average cost of capital rates defined by the Federal Department of the Environment, Transport, Energy and Communications (DETEC) for the 2023 financial year are 3.83% for 2023 (WACCt+0) and 3.98% for 2025 (WACCt+2). In 2023, EBIT increased by CHF 13.0 million from the previous year’s value of CHF 125.2 million to CHF 138.2 million. The increase in EBIT is due to the higher net deficits and the resulting higher interest expense. The portfolio of loans and bonds was expanded in the 2023 financial year to finance ongoing investments and procurement costs, leading to a rise in financial expenses of CHF 6.1 million to CHF 20.8 million (previous year: CHF 14.7 million). Net income in 2023 amounts to CHF 100.0 million, up from the previous year’s figure of CHF 96.4 million.

Balance sheet and cash flow statement

Total assets (excluding fiduciary positions) increased by CHF 383.1 million compared to the previous year to CHF 4,219.6 million. The absolute equity base was further strengthened by the positive net income less dividends paid. Adjusted for the balance sheet items held on a fiduciary basis and volume- and tariff-related timing differences, the equity ratio on 31 December 2023 amounts to 32.1%, as compared to 33.9% on 31 December 2022. The decrease in the equity ratio is due to the higher total assets resulting from the rise in volume- and tariff-related timing differences and the increase in financial liabilities to cover liquidity requirements.

In 2023, cash flow from operating activities amounts to CHF –505.4 million, an increase of CHF 356.1 million compared to the previous year’s value (CHF –149,3 million). The cash outflow is due to the high procurement costs from operating activities and the costs for the power reserve.

With a gross investment volume of CHF 279.5 million, Swissgrid again realised more investments than in the previous year (CHF 257.4 million). In addition, the auction income received for the maintenance and expansion of the transmission grid decreased. Higher cash flow from investing activities of CHF –40.5 million was therefore generated year on year (previous year: CHF –3.9 million).

To cover liquidity requirements, in particular for financing the costs of the power reserve, financial liabilities rose by CHF 548.9 million compared to the previous year. After deduction of the dividend and interest paid, cash flow from financing activities stood at CHF 484.2 million in the reporting year (previous year: CHF 53.4 million).

Risk assessment

Risk management is an integral part of effective and prudent corporate management for Swissgrid. It covers the entire organisation, not including its subsidiaries and shareholdings. It is based on the established ISO 31000 and COSO ERM standards and meets the requirements of corporate governance as well as the requirements under Swiss law.

Objectives

The Risk Management unit assists employees at all levels in consciously dealing with risks. This includes expedient and transparent reporting as well as managing an appropriate risk management system. Swissgrid fosters the deliberate management of risks at all levels of the company.

Organisation

The Board of Directors has defined the governance requirements for risk management and delegated its implementation to the CEO. The head of Enterprise Risk Management manages the risk management process, provides the methods and advises the operating units on risk management.

Process

The risk assessment takes place twice a year. The key risks are identified and assessed as part of a multi-stage process that includes the evaluation of risks based on the probability of their occurrence and the extent of their impact, as well as the definition of strategies to manage said risks.

Risk monitoring, including the effectiveness and level of implementation of the measures taken, is performed as part of regular risk updates. The Executive Board and the Board of Directors receive the results of the risk assessment and the risk updates in the form of a standardised report.

Risk situation

The risk of a power shortage in the winter of 2022/2023 rose due to the conflict in Ukraine and the associated loss of Russian gas imports to Europe, as well as the low availability of French nuclear power stations. The resulting massive distortions on the European energy markets increased the likelihood that the volume of energy on offer could be insufficient. In order to keep the grid stable and to supply it with the necessary volume of electrical energy at all times, Swissgrid implemented the following measures to strengthen security of supply, partly also on behalf of the federal government:

- Early procurement of sufficient control energy to keep the generation and consumption of energy in the grid constantly balanced in the short term.

- Temporary increases in the operating voltage on selected lines in the transmission system to increase transfer capacity in emergency situations.

- Creation of energy reserves outside the market (strategic hydropower reserve in the event of extraordinary shortage situations and an additional energy reserve using reserve power plants).

- Preparations to operate a national virtual reserve power plant from emergency power units.

These and other measures, and the calming of the European energy markets, defused the situation ahead of the winter of 2023/2024.

However, the effects of the tense geopolitical situation, extreme climate events (persistent dry weather and a «Dunkelflaute» in Europe, i.e. a period without any wind or photovoltaic production) or cumulative outages of large power plants can accentuate the risk again. This is especially true in the winter months, when Switzerland is dependent on electricity imports.

In addition to the risks associated with security of supply, the existing risks remain relevant for Swissgrid. The drivers for these risks are natural influences, the national and international political and regulatory environment as well as personnel and technical factors. Digitalisation is enabling more efficient operation of the transmission grid, but also involves risks to grid and system security and therefore to security of supply, given the growing dependence on complex and networked ICT systems and their susceptibility to cyber risks.

The key risk factors are:

European and regulatory environment

The Swiss transmission grid is part of the continental European interconnected grid and is connected to neighbouring countries via 41 cross-border lines. The close meshing of the electricity system and cooperation with European partners to date make a significant contribution to Switzerland’s security of supply. Swissgrid’s role remains challenging at a national and international level. After breaking off negotiations on a framework agreement in 2021, the Federal Council is endeavouring to resume talks in 2024. At the time of reporting, the date of the conclusion of an electricity agreement and its content are not known. The Swiss electricity system therefore remains excluded from important processes affecting grid security in Europe. This leads to higher unscheduled flows of electricity through the Swiss grid and jeopardises both system stability and import capacity in the medium term. Swissgrid is developing technical solutions and negotiating private-law agreements with other transmission system operators to ensure the stability of the grid, but is reliant on political support in this respect. Success is not guaranteed as there are aspects to resolve at a political level that fall outside the control of Swissgrid. Private-law agreements between transmission system operators are not an adequate substitute for an electricity agreement in the long term.

Security of supply

A wide-scale supply outage would cause enormous economic damage. Consequently, Swissgrid must keep the transmission system available for the supply of electricity at all times. It is therefore essential to have an intact grid infrastructure and to secure the availability of IT and communication systems. Meeting these prerequisites can be jeopardised by, for example, technical problems, natural disasters, operating errors and criminal actions. Among other measures, Swissgrid mitigates these risks by implementing redundancies and standardised processes to eliminate faults in grid systems and in system operations. Adequate training and development of personnel ensures that employees respond appropriately.

Security of supply also depends on the availability of control and redispatch power to balance short-term deviations between production and consumption, and to control grid congestion. The shift from large thermal power plants (nuclear and coal-fired power plants), which supply constant and deterministic electrical energy, to decentralised, volatile solar and wind power plants as part of the energy transition is making it increasingly difficult to meet these conditions. Swissgrid therefore works continuously to optimise the Swiss market for ancillary services, and cooperates with transmission system operators in neighbouring countries to increase market liquidity.

Swissgrid takes precautions to protect the infrastructure against physical attacks. The project to physically protect substations is one of the main activities in this area and involves securing the relevant buildings and plants, as well as access control and monitoring.

The threat of cyber attacks is steadily rising due to the speed at which technology changes (which potential attackers also exploit), the countless possible modes of attack, as well as growing system integration across companies. To reduce this risk, Swissgrid is continuously developing its processes and systems to detect cyber threats early and defend itself against them.

Swissgrid has emergency procedures and structures in place in the highly unlikely event that infrastructures or systems fail permanently or the grid can no longer be controlled. Exercises with authorities and industry partners also took place again in 2023, such as practising OSTRAL procedures and carrying out regular grid restoration exercises with distribution system operators and foreign transmission system operators.

Grid capacity

Planning for the further development of grid capacity is based on scenarios that consider future target values for generation technologies and consumer groups, taking into account the transformation of the energy system with regard to the energy transition. Important strategic grid expansion work continues to be affected by lengthy approval procedures due to large numbers of objections. This makes it more difficult to eliminate grid congestion. As far as approval processes are concerned, Swissgrid relies above all on dialogue with affected parties. However, given that the acceptance of overhead lines is often low, Swissgrid still has to factor in objections and delayed approval processes.

The progressive ageing of existing components represents another risk to grid capacity. Swissgrid therefore systematically records the condition of its plants and plans modernisation measures accordingly.

Personnel safety

Swissgrid’s operation and maintenance of the extra-high-voltage infrastructure involves risks to personnel safety. People can be seriously injured while performing their work. To minimise this risk, Swissgrid systematically identifies present dangers, implements targeted protective measures, trains its own employees and instructs contractor employees so they can independently identify the dangers posed at plants and respond accordingly. Systematic local inspections help to ensure compliance with safety precautions on building sites. «Safety first» is the guiding principle.

Financial risks

Swissgrid’s activities mean that it is exposed to various financial risks. These include liquidity, foreign currency, interest rate and counterparty risks.

Depending on the financial volume and timing, the financial implementation of the measures envisaged by the federal government to ensure security of supply (power reserve) may mean that Swissgrid has to provide interim financing for these resources, which are to be funded via downstream tariff revenues. Swissgrid therefore took measures at an early stage to ensure liquidity at all times by means of intensified continuous planning, close monitoring of the funding requirements, an increase in minimum liquidity levels and the provision of confirmed bank credit facilities.

Foreign currency risk is reduced through natural hedging and forward exchange transactions. The hedging strategy is reviewed periodically and updated as needed.

The risk of interest rate changes is reduced by staggering the maturities and establishing a balanced financing mix. Derivative financial instruments are deployed for further mitigation if necessary.

Financial counterparties are constantly reviewed, assigned individual limits and monitored. Counterparty risks are monitored on a regular basis.

Future prospects

Strategic outlook

The electricity industry is undergoing a process of radical change which is significantly modifying the framework conditions for transmission system operators. The transformation of the energy system is leading to a loss of reliably predictable electricity generation in favour of an increase in decentralised and renewable electricity generation, which is resulting in new requirements for grid operations. Changes must also be made to the grid infrastructure on account of these changes in electricity generation so that the transmission system operators can continue to guarantee grid-related security of supply. At the same time, the EU and Switzerland are modifying the political and regulatory requirements for the electricity industry. The situation is made even more difficult for Swissgrid by the lack of an electricity agreement with the EU: Switzerland is increasingly excluded from European processes, committees and cooperation.

Swissgrid is addressing these and other challenges in its Strategy 2027, which was launched in the past reporting year. This marked the start of a new five-year strategy period for the company. Information on the strategic areas of action and the priorities of the new strategy can be found under Strategy 2027.

Outlook for 2024

Strategy 2027 lays the foundations for the 2024 corporate objectives. The plans for the Strategic Grid 2040 are to be finalised and submitted to the Federal Electricity Commission ElCom for review. Swissgrid prepares its grid planning on the basis of the Swiss Federal Office of Energy’s scenario framework and the ENTSO scenarios set out in it. The Strategic Grid supports the implementation of the Energy Strategy 2050 and increases the controllability of the grid in the long term.

The degree of digitalisation is being increased with specific projects such as the introduction of business information modelling. The first corresponding pilot projects for substations and lines will be launched in 2024. Swissgrid is also taking practical measures to automate internal company processes, including the establishment of a centre of excellence for automation. Swissgrid’s efficiency can be significantly increased by the use of consistent digitalisation and automation.

In 2024, the focus will also be on further investments in safety, training and employee development. Swissgrid intends to introduce a skills management system to define the future requirements for employees and to develop them where necessary. The aim of this programme is also to attract new employees to Swissgrid.

The further development of the sustainability strategy is another priority. Swissgrid will clarify its short, medium and long-term objectives for selected topics that the company has defined as material. The new measures and their effectiveness will be presented once again in the 2024 Annual Report and Sustainability Report.

Research and development

Swissgrid collaborates with national and international research institutions to ensure that it can continue performing its duties safely and cost-effectively in the future. Its project portfolio is aligned with its strategic goals, and consists of internal activities and projects being conducted in cooperation with universities and other Swiss partners.

Financial outlook

Grid investments

Investment volumes are expected to remain high due to the need to achieve a sustainable energy future and carry out the measures defined in the «Strategic Grid 2025» report. Permits for power line construction and modification continue to pose a major challenge. The budget has therefore been assigned a lower likelihood of realisation in order to properly reflect delays. Consequently, investments in the grid are expected to increase by between CHF 200 million and CHF 290 million a year over the medium term.

Operating costs

In the past reporting year, Swissgrid launched its Strategy 2027 and entered a new five-year strategy period. Strategy 2027 will enable Swissgrid to address the challenges posed by the fundamental transformation of the energy system. Implementing these measures will lead to a rise in operating costs.

EBIT and net income

EBIT is directly dependent on the invested operating assets (IOA) and the weighted average capital cost rate (WACC) in line with the regulatory business model. The WACC communicated by the Federal Department of the Environment, Transport, Energy and Communications (DETEC) for 2024 is 4.13%. Consequently, an EBIT or net income in line with 2023 is expected for 2024.

In accordance with the dividend policy approved by the Board of Directors, the income generated will be retained in the long term on a pro rata basis depending on the equity ratio and the financing situation. This safeguards Swissgrid’s long-term financial stability.